Pet Insurance Annual Review and Renewal

In 2022, our pet insurance through Embrace Pet Insurance was going to go up a lot. I don’t remember the exact percentage, but it was enough to shock me after several years of steady increases in monthly premiums. Our 3 pet insurance policies through them for Clover, Tori, and Mr. Stix renew again in September 2023. No surprise, I suppose. The cost is going up another 24%.

To cut back last year, I doubled our annual deductible from $500 to $1,000, and I lowered our reimbursement rate from 80% to 70%. And, a year later, we’re kind of back where we were. I always ask myself if it’s worth the cost. Let’s look at the numbers, including how much the pet insurance market grew in the last year. Funny (not funny) how the % of industry growth nearly matched the % of increase in our premium costs.

Is Pet Insurance Worth It?

I ask myself that all the time. Truly. After what happened to our original canine heroine, Lilly, whose very basic pet insurance policy topped out quickly with low lifetime payouts, I do think pet insurance is worth it *if something bad happens. That doesn’t mean, though, that I don’t resent the costs and feel like it’s a bit of a scam at times, especially since the founders of the pet insurance company we use no longer hold a leadership role in the business. (Things have changed. Not for the better.)

Especially with how much the cost of everything keeps going up, including veterinary care, what used to stagger us at $3,000 for a veterinary ER visit might now be a lot more. Just last weekend, a friend’s puppy suffered an intestinal blockage, and the initial estimate for surgery topped $10K. No kidding. It ended up NOT costing that much, but some of us still chipped in some $$ to help because the puppy does not have pet insurance.

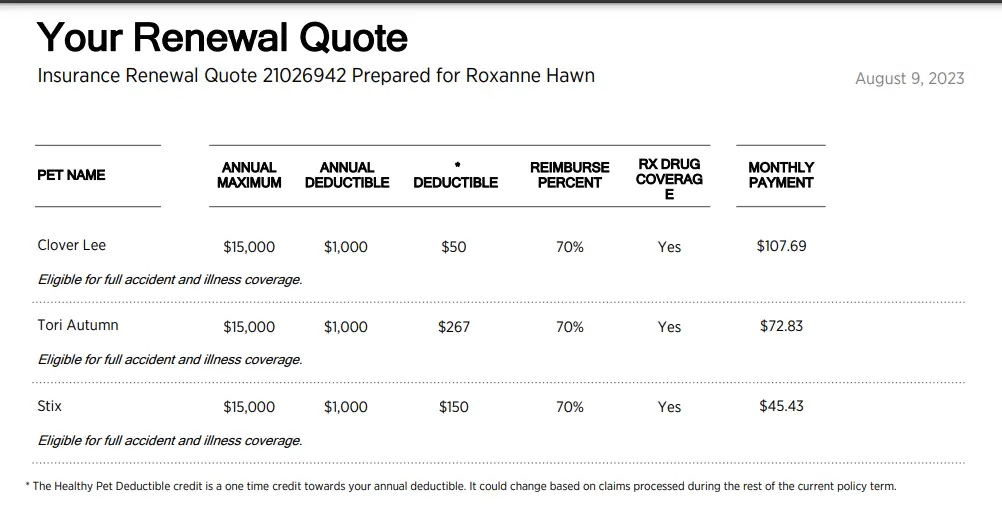

Our Pet Insurance Premium Costs for 2023-2023

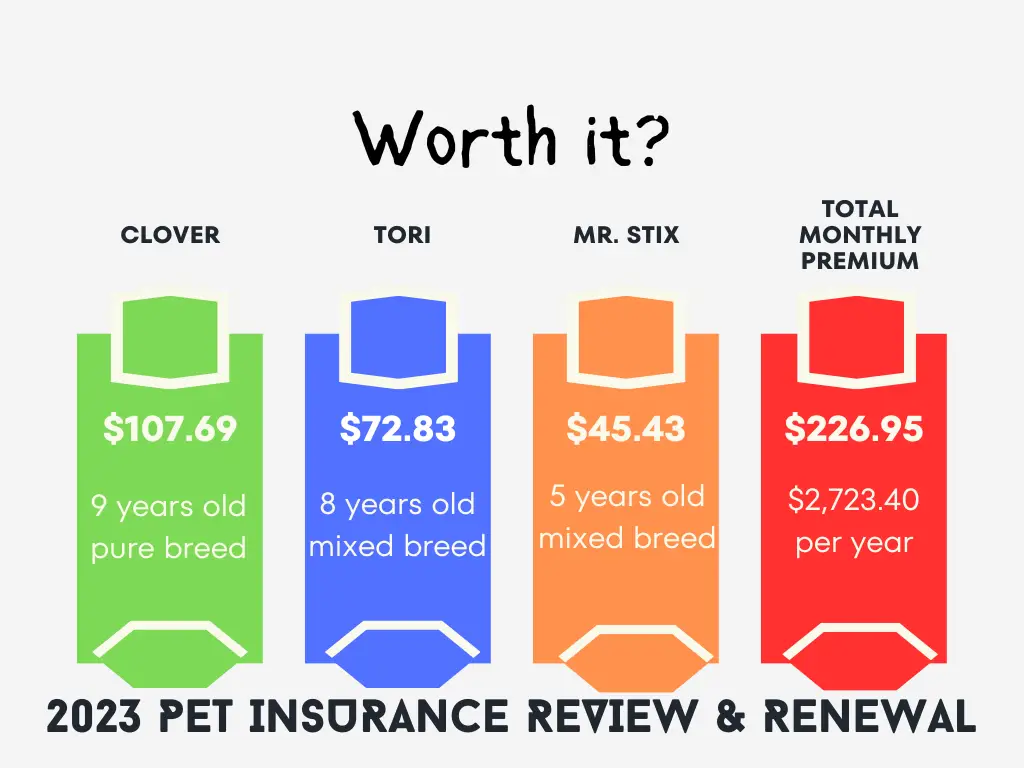

The graphic above shows the monthly premium costs for all 3 of our dogs:

- Clover = $107.69 / month

- Tori = $72.83 / month

- Mr. Stix = $45.43 / month

- Total = $226.95 / month, which is $2,723.40

Just this week we also got the renewal notice for our home insurance. Pals experienced huge shocks about their renewals since the “value” of real estate got reassessed recently. Those numbers feel staggering and honestly silly. Thankfully, our home insurance went up, but not an insurmountable number. An anger-inducing number? Yep, but it wasn’t 2, 3, 5 x the amount as others we know face.

And, yet, it now costs $36 more per year to insure our 3 dogs than it does to insure our house and all of our possessions.

I probably shouldn’t have made the comparison / calculation because now I’m adding up what we pay for *all of our various insurance, and it’s making me crabby. Between that an self-employment taxes, it’s a wonder I have any $$ left to live.

What affects pet insurance costs?

Breed. Based on the cost differences between Clover, who is a purebred border collie, and our other dogs Tori and Mr. Stix who are both mixed breed dogs, purebred dogs are MORE expensive to insure.

Age. Clover is also the oldest, so I anticipate that all of their monthly pet insurance premiums will continue to increase based on age.

Exclusions. Mr. Stix’s pet insurance policy included an extensive and lifelong dermatology exclusion because he had an ear infection when first rescued. I call 100% BS on that decision by the company. I feel like it’s a form of discrimination against rescued dogs who arrive at shelters injured and ill. That means when he later developed an honest-to-pete skin issue the pet insurance company did NOT help at all. Maybe that’s partly why his premium is lower, in addition to age and being mixed breed.

Policy Details. The details of the policy also affect how much pet insurance costs such as:

- Annual deductibles (how much you must pay out of pocket before the pet insurance will start reimbursing costs)

- Annual limits (how much the pet insurance company will pay per year)

- Other limits (how much the pet insurance company will pay per things like illness, injury, or bodily systems)

- Reimbursement rate (how much of each veterinary bill they will pay)

Here’s how our policies stack up on those things.

- Annual deductible for each dog = $1K

- Annual limits for each dog = $15K (no lifetime limits)

- Reimbursement rate = 70%

Pet Insurance Industry Stats

According to the latest State of the Industry Report from the North American Pet Insurance Industry Association, the pet insurance market experienced 23.5% growth in year-over-year revenue in 2022. The skeptic in me can’t help but notice that nearly matches our year-over-year premium increase.

Other data gathered shows:

- More than 5.36 million total pets insured in North America (which is a 21.7% jump over 2021)

- A record of $3.51 billion (with a B) in US dollars paid in total premiums (that’s the 23.5% increase noted earlier)

And, yet, even in the states with the most insured pets such as California, only 18.6% of pets in the state have pet insurance. The national average is much lower, like just a few %.

Well Above Average, Not in a Good Way

The average accident / illness policy premium for dogs is $640.04 per year or $53.34 per month. Clover’s policy costs double that amount. Tori’s costs 1.4 x that mount. Stix is a little below that. So, we’re above average in many ways, and not in a good way, which is kind of typical for my life with dogs. Mine tend to develop expensive issues.

For now, though, I plan to celebrate the relative good health of our 3 dogs:

Clover has been having a little tummy trouble lately, but special tummy food + probiotics seem to help.

Tori recently got diagnosed as hypothyroid, but the meds don’t cost too much and seem to be helping (based on repeat bloodwork).

Mr. Stix had a good recheck with his DVM dermatologist. So much so that we can now go to once-a-year rechecks, unless something comes up. His skin will never be perfect again, but we’re at a manageable level with a combo of 4 meds (2 topical, 2 oral).

And, I’ll keep looking for other places in our budget to cut to make up for the increases in everything lately.